Car Import Tax Usa

Tax will be due on the cost of the goods and shipping which in this case is 22000 15000 7000. Essentially this is as follows.

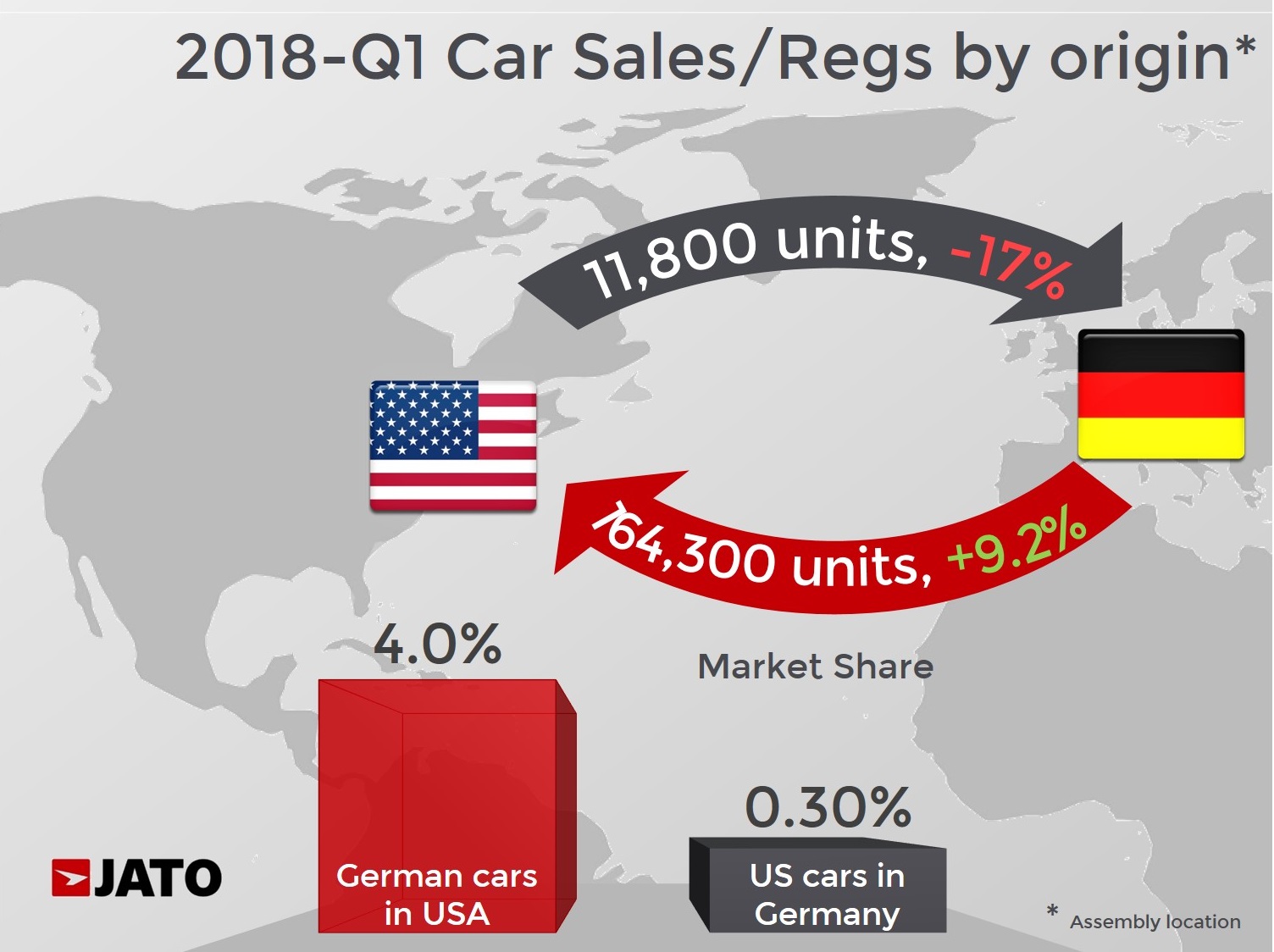

Trump Vs German Cars The Truth Behind It Jato

Resident is one who is returning from travel work or study abroad.

. The duties are applied whether you are a dealer that is importing multiple vehicles or a private owner that is only bringing one car into the country. 65 of 28000 is 1820. Financially the answer is very often no.

So for the good and customs duty youll pay 29820 in total. Gas Guzzler or Green Levy Tax If your car is manufactured after March 19th 2007 and consumes 13 litres or more per 100 km it will may be subject to an excise tax of 1000 to 4000. To find out how much youll need to pay youll need to check the commodity code for umbrellas and apply the import duty rate for that code 45.

Motorcycles- 3 or 34. Should you import a car from the US. Most cars manufactured in Canada are duty-free in the US.

However there are quite a. Most Canadian-made vehicles are duty-free. Is imported for personal use.

USA Car Import from America and Canada of new and pre-owned cars. There you will find the rate for your vehicle. Therefore the taxable amount and import rate is 90 3 of 3000.

7 in applicable provinces. Motorcycles Free or 24. To find out how much youll need to pay youll need to check the commodity code for umbrellas and apply the import duty rate for that code 65.

To find out if additional taxes and fees are required on the goods you import and the amount you should contact an import specialist at the port of entry through which the goods will be entering the United States. A vehicle is new if either. After the exemption has been applied a flat duty rate of 3 is applied toward the next 1000 of the vehicles value.

There will be merchandising processing fees that are usually a couple of dollar. Import duties 10 for a car and pick-up when lenght of the bin is less than 50 of the lenght of the wheelbase Import duties are 22 for a truck including pick-ups with a bin longer that than 50 of the lenght of the wheelbase. 61 tax on non-NAFTA vehicles Toyota Honda Subaru etc Goods Service Tax GST.

The cost for cars is 5 and that for trucks and lorries is 25. Some cars were sold in multiple countries so those cars if exactly the same or have a united states safety rating would be able to be imported to the USA. NJ CAR Title Services.

USA Customs Import and Export Duty Calculator. In total I wont be paying more than roughly 100-120 for import rates and duties. Cost of importing a car.

Foreign-made vehicles imported into the US whether new or used either for personal use or for sale are generally dutiable at the following rates. There is a list online of all the vehicles newer than 25 years as of 2015 or 2016 that were legal to import to the US. First you can go to this link to get an import excise tax right from the source.

If you are importing cars from manufacturers in other countries following the importing rules other countries impose is crucial. At the time of this writing we entered a sample 2010 Honda Accord. Find the proper import duty or tax for your automobile imports which require a customs bond.

So for the goods shipping and import duty youll pay 22990 in total. If you imported the vehicle to Northern Ireland from the EU. Calculate import duty and taxes in the web-based calculator.

You will pay 20-2 if you have an account. Provincial Sales Tax PST. Any foreign-made vehicle imported into the USA will be have to pay custom duties at the given rates.

5 of total vehicle value. Was acquired during the journey from which you are returning. For CBP purposes a returning US.

A charged rate of 0-2 is applied. Due to privacy regulations NJ CAR is unable to obtain information regarding the status. Vehicles imported into the United States will be subject to an import tax based on their price at the time of purchase in the US.

By providing our team of brokers with several pieces of key information we can determine the rates due and assist you in clearing the products. Duty rates are based on price paid or payable. VAT is usually only charged on vehicles that are new.

In addition to duty and possible excise tax goods imported into the United States are subject to user fees. Find Out The Cost to Import. Basically it would seem that every vehicle imported into the US would be subject to import tariffs based on its value at purchase time.

Foreign-made vehicles on the other hand are generally dutiable. Duties and taxes to import the vehicle to US. Autos- 25 Trucks 25.

You will have to give these fees and will cost the same regardless of your vehicles condition and purpose of use. A motorcycle is taxed 4 a motorcycle is taxed 2. How Much Is Import Tax On A Car From Usa.

Tax will be due on the cost of the goods without shipping which in this case is 28000. The user fee and. Either free or 24.

200 fee on all vehicles. Importduties are 27 for a boat and 7 for a motorcycle depending on the country. It then gave us a total of 1259 to import that vehicle.

Many of the Canadian vehicles are duty-free. How Much Is Import Tax On A Car From Usa. The following rates apply.

Currently the duty on cars is 25 and the tax on motorcycles is 24 of the price of the vehicle. Importing a Car From the United States into Canada. Goodadas USA customs import and export duty calculator will help you identify the export tariff rates you will pay for the USA.

United States Import Regulations. 45 of 22000 is 990 22000 0045. Dealerships also have the option of sending the appropriate documents for an Import Vehicle directly to the NJMVC offices at the following address.

There is a 4 tax on motorcycles and a 22 tax on scooters. USA-CAR-IMPORTCOM NEW LOW MILEAGE VEHICLES WORLDWIDE DISTRIBUTION. When you are importing cars to USA follow the importing timeline and dont miss any deadlines.

Its fast and free to try and covers over 100 destinations worldwide.

Trump Vs German Cars The Truth Behind It Jato

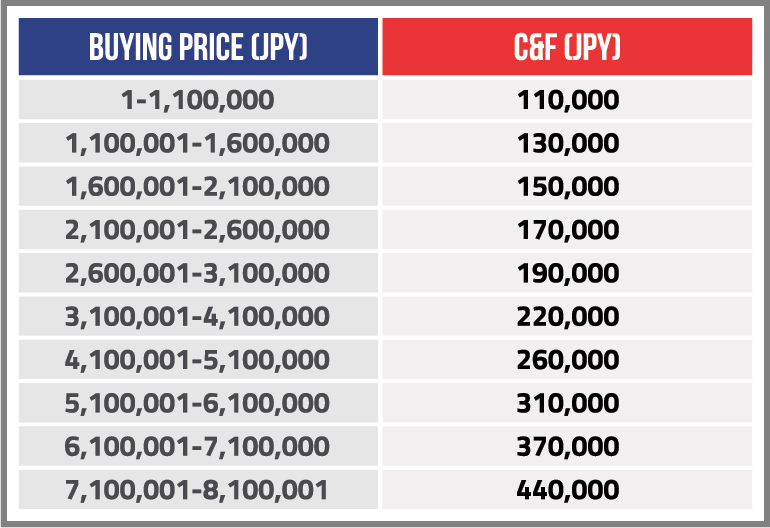

What S The Cost Of Importing A Car To India From Usa

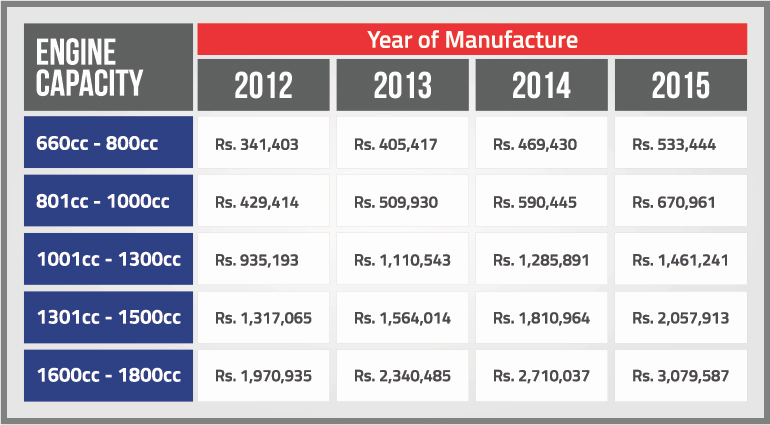

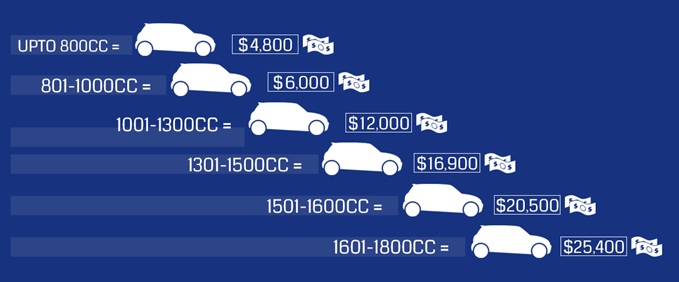

Custom Duty On Cars In Pakistan Car Import Duty Calculator Pakwheels

Custom Duty On Cars In Pakistan Car Import Duty Calculator Pakwheels

Importing Cars To The U S Clearit Usa

Solved How To Import A Vehicle From The Us To Canada In 4 Steps Up Running Technologies Tech How To S

How Much Is The Import Tax On Premium Cars In India Quora

All You Need To Know About The New Vehicle Taxes

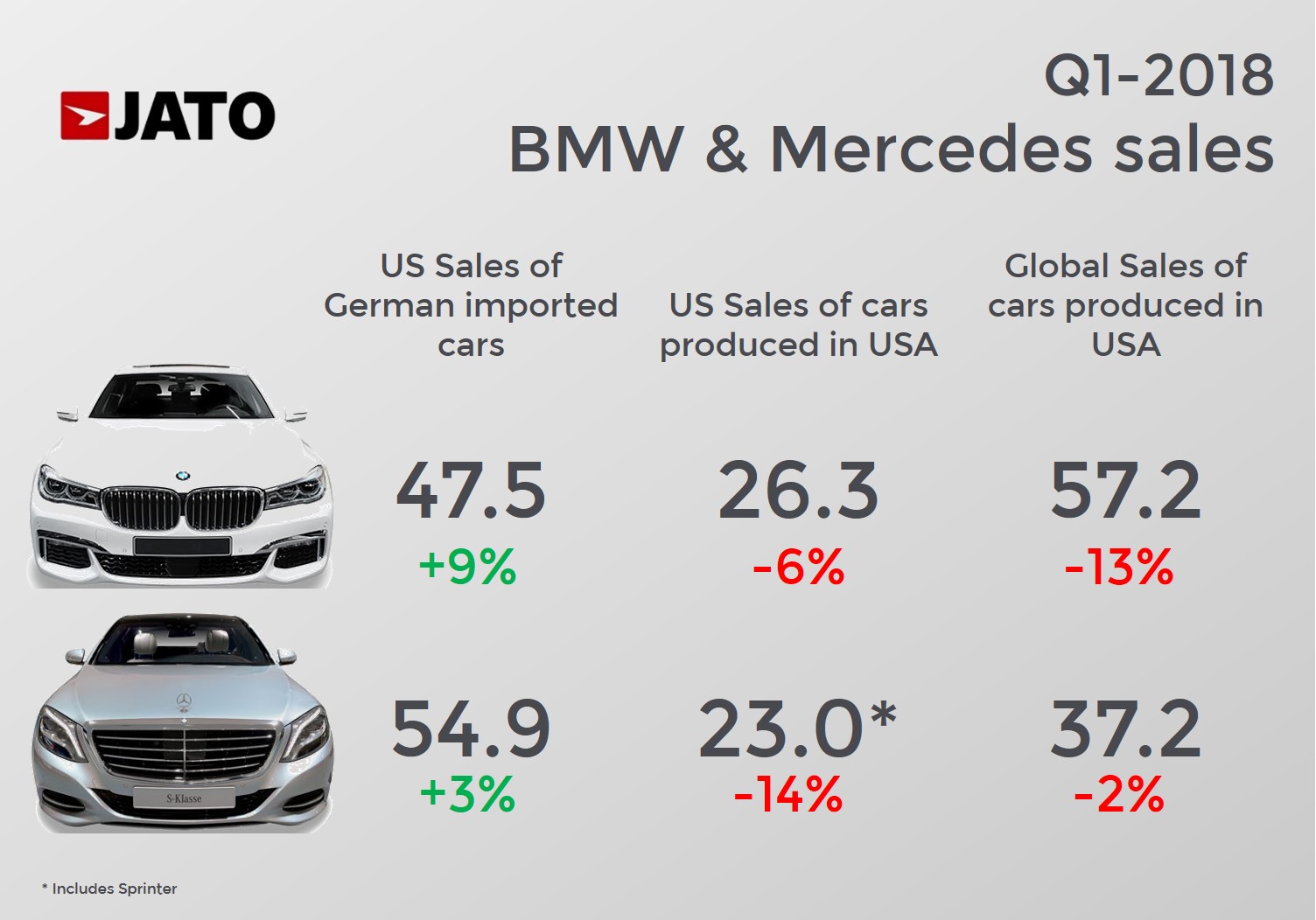

Trump Vs German Cars The Truth Behind It Jato

Import Duty On Luxury Cars Such As Mercedes Bmw Audi Bentley Jaguar Rolls Royce And Others

Moving Your Car Overseas Things To Keep In Mind Shipping Car From Uae

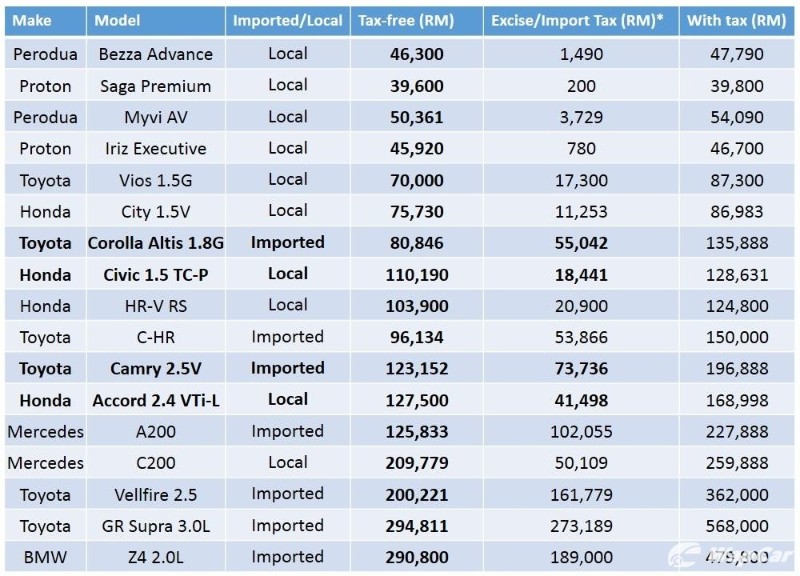

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

How Much Does It Cost To Transport Your Us Car To Europe

Japanese Automakers Build Twice As Many Cars In U S Than Import

Calculate Import Duties Taxes To United States Easyship

Car Import Duty How To Calculate Car Duty In Bangladesh Car Duty Calculator In Bangladesh Youtube

0 Response to "Car Import Tax Usa"

Post a Comment